Loading content …

12 November 2020

The ECB as Subsidiary Government

The fact that Joe Biden won the US presidential election has no effect on real estate markets in the United States. But it is excellent news in terms of climate policy – including in Europe. Meanwhile, the ECB has raised eyebrows on this side of the Atlantic with the attempt to expand its mandate. In addition to monetary policy, the central bank would like to play a role in climate and European politics. But any move in this direction will be preceded by a shift in interest rates this December. Moreover, the concluding month of the year could see the introduction of the condominium conversion freeze in Germany.

The election of Joe Biden as next president of the United States will have no immediate consequences for the country’s real estate markets. Low interest rates are still the dominant influencing factor, and these will remain low, here as elsewhere. The economic crisis in the wake of the COVID-19 pandemic leaves the Federal Reserve Bank no leeway for interest hikes. For Europe this is a piece of good news, because the European Central Bank (ECB) will not be put under pressure to raise its interest rates by any US interest moves.

What sets Joe Biden apart from Donald Trump is not least that he intends to take effective steps against climate change. This is reassuring for the EU and the European economy because the support provided by the US will relieve the EU of the pressure to slow climate change on its own, as it were. This could keep the EU from tightening its climate regulations at an even faster rate. For the German real estate industry, this is rather good news. And hopefully for the climate as well.

ECB Seeks Role in Climate and European Politics

Climate politics in Europe are getting support from an unexpected corner. Christine Lagarde, the ECB President, is once again making a case why the central bank, whose political mission is mainly to ensure price stability, should also play an active role in climate protection. Lagarde argues, on the one hand, that climate change poses a threat for price stability and, on the other hand, that it is the ECB’s job to correct market failures. Although the cause of climate protection deserves all the support it can get, we believe that the ECB is clearly exceeding its remit.

As if this was not enough, Lagarde proposed a short while later to turn the EU Reconstruction Fund of 750 billion euros, for which all member states are liable collectively, into a permanent institution. Again, our criticism would be that the ECB exceeds its competencies by advocating a debt union. The ECB is not a subsidiary government. So, it is not only overstepping the limits of its mandate. It is also risking the loss of its most valuable asset: political autonomy.

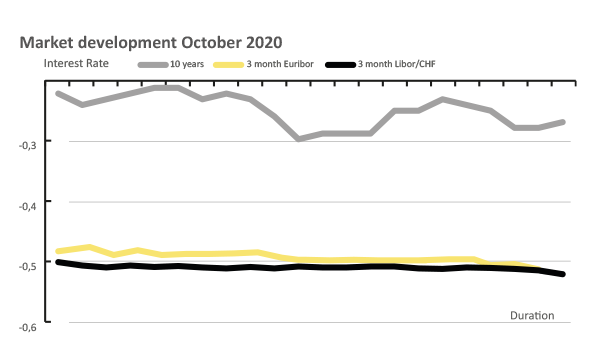

Aside from that, the ECB should have its hands full mitigating the consequences of the coronavirus crisis. ECB Director Isabel Schnabel already announced interest rate cuts for December. We have every reason to assume that the ECB did include the real estate market in its analyses. But whether or not that market will benefit from another interest rate cut remains to be seen.

Let us move on from monetary policy to another subject at least as important for the sector – the condominium conversion freeze. We are cautiously speculating that the ban on the conversion of rental flats into condominiums will be signed into law. This would force the governments of the German states to pass the corresponding regulations.

Outlook

Waxing philosophical, the ECB has recently advised banks to hope for the best while nonetheless bracing themselves for severe economic consequences of the pandemic. For the real estate industry, the elevated risk in the area of commercial real estate persists therefore. By contrast, we continue to expect the low level of interest to keep prices stable in the housing sector.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof Steffen Sebastian

Prof Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG