Loading content …

19 June 2020

The New Normal – Real Estate Financing after the Lockdown

Initial transaction figures show only minor ramifications from the coronavirus crisis. As a result, the terms of financing have improved again. Yet it would be premature to sound the all-clear signal.

This edition is the third since the onset of the COVID-19 pandemic, and still the latter remains a subject we need to address. Fortunately, the first data since the outbreak have now become available, so that we no longer need to rely on opinions and speculation alone. Initial figures from April show that, while sales went down noticeably, prices have remained largely stable or indeed have registered modest growth. This matches our own observations. Sentiment among market players is brightening gradually, and they have tentatively resumed presenting transactions to lenders for financing.

In macroeconomic terms, the pandemic doubtlessly caused, and will continue to cause, serious economic dips. Events appear to bear out our speculations in the April issue that the real estate market may be less affected than other industry sectors. The low level of interest and the high pressure to invest that is felt mainly among institutional but also among private investors appear to bolster real estate prices during the crisis. However, we have noted that some buyers try to take advantage of the current situation in order to renegotiate prices. But since financing banks are exerting no pressure, there is no reason for sellers to yield at this time.

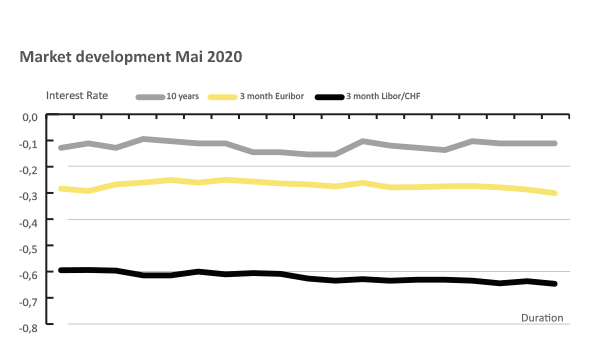

In the absence of price crashes, sentiment has also brightened among financiers. The effects of the crisis are no longer being felt on the interest rate market either. Moreover, the refinancing terms for banks have improved – not least due to the support provided by the European Central Bank (ECB). Banks have responded by signalling more interest in new lendings again. In short, we are seeing the first signs of a return to a new normal.

Outlook

Despite all signs for improvements, the situation remains precarious. There is still every chance that the number of new infections could resurge, and thereby prompt another lockdown.

Residential real estate is stable for the time being, and so are evidently large parts of the office market. If the economic situation were to deteriorate again, one would have to wait and see if the real estate market will continue to be spared to the same extent we have seen so far. The question of key significance for many operator properties, however, will be whether the operating companies will survive the crisis and, if so, how many of them. In the short run, German hotels could benefit from the situation because many Germans will prefer domestic holiday destinations this year. But even if this made it possible to raise room rates, it would not suffice to make up for two months of lost revenues.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof Steffen Sebastian

Prof Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG