Loading content …

28 February 2020

ECB has only limited power over interest rates

Low interest rates are often blamed on ECB policies. But rates are very low in all other countries, too. The causes are global and will not change quickly.

Christine Lagarde, the new president of the European Central Bank (ECB), spoke about future monetary policy in contradictory terms immediately after taking office. Everything is under scrutiny, said Lagarde. Even the policy of low interest rates? She expressly stated that the effectiveness and side effects of monetary policy instruments are to be reviewed, while also saying that monetary policy will remain expansive for the time being.

Although we do not believe that these statements by the ECB president should be interpreted as her announcing an interest rate turnaround, we are seeing a strong response by market participants. Before Lagarde was appointed president, market participants expressed virtually no interest whatsoever in interest rate hedging. Now, demand for fixed interest rates and other hedging instruments has once again soared.

For a number of years, experts have argued that central banks are only partially responsible for low interest rates and that rates across the world will remain low for a long time to come. They believe this is a result of the global supply of capital exceeding demand, as increasing numbers of people around the globe are making private arrangements for their old age.

Clemens Fuest and Timo Wollmershäuser from the ifo Institute in Munich, for example, attribute low interest rates to a number of factors, including high levels of saving in industrialised countries and emerging markets, low investment by governments and companies and demographic change. They put the impact of current monetary policy at around just 2%. In other words, even if the ECB were to abandon its current low interest rate policy, rates would rise by only about 2%.

Many authors also expressly disagree with the argument that the ECB keeps interest rates artificially low to provide cheap loans for the southern member states. You do not have to agree with this statement. But no alternative solutions are being discussed at this point for these states’ high levels of debt or the impact of higher interest rates.

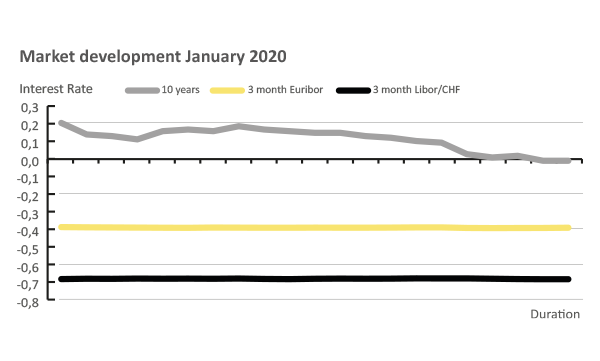

Interest rate trends

Long-term interest rates declined again in January. The ten-year interest rate swap was at 0.21% at the start of the month and dropped to -0.02% over the course of the month. The six-month Euribor also fell slightly from -0.323 at the start of the month to -0.338 at the end. The three-month Euribor also dropped from -0.379 to -0.393% over the course of the month.

Outlook

We do not expect the ECB to abandon its low interest rate policy for the time being. Nonetheless, it is very likely that instruments will be thoroughly reassessed, with bond purchases potentially being replaced at least in part by other measures. Despite this, we believe that interest rates will remain low for the foreseeable future.

Notwithstanding, short-term developments should not be discounted. For example, the conditions for ten-year swaps declined again considerably at the start of the year, although the current level has not yet reached the record low seen in August 2019.

Our conclusion: Even if you believe experts when they say that interest rates will remain low even in the very long term, there are many arguments in favour of fixing long-term liabilities in the long term as well.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof Steffen Sebastian

Prof Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG