Loading content …

21 August 2020

Condominium Prices Keep Rising despite COVID-19

Prices for German condominiums have kept going up even in the months since the onset of the coronavirus crisis. For the time being, the consequences of the low level of interest continue to outweigh those caused by the recession – as well as the fear of a further deterioration of the economic situation. Meanwhile, the plans for housing policy changes have progressed despite the parliamentary summer recess as preparations for a “condominiumconversion freeze” continue.

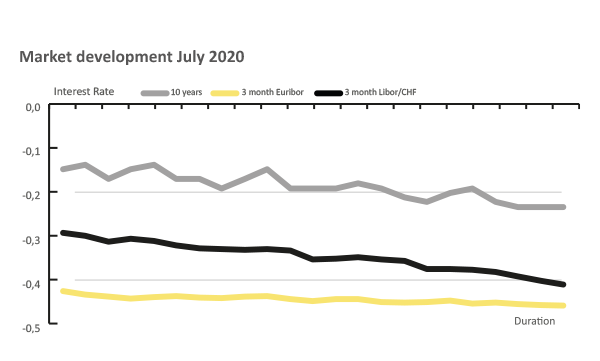

Now in its fourth month after being introduced to Germany, the COVID-19 pandemic and its repercussions for the real estate market remain the dominant subject in the industry. The actual repercussions vary considerably from one type of use to the next. The outlook for hotels and other lodgings, for instance, has kept dimming. The coming month could also see student housing get into troubled water. It is understood now that the crisis for real estate of these types will not end until an effective vaccine against COVID-19 has been found and become generally available. The bankruptcies of the hotels Crowne Plaza in Heidelberg and Sofitel on Berlin’s Kurfürstendamm will surely not be the last. On a brighter note, the situation is sure to present lucrative opportunities for high-net-worth investors with a long-term horizon. Obtaining financing for this segment, however, has become difficult. By contrast, residential real estate remains as attractive as ever. The interest in tier two locations has further increased here. The upward price trend of recent months has confirmed our assumption that low interest rates will keep acting as the main driver of condominium prices even during the ongoing crisis. It remains to be seen whether this will continue to apply once the recession deepens. Yet our guess would be that condominium prices will in any case prove stable. Moreover, capital market rates have lately dropped to a level that is low even by the standards of a low-interest cycle. Then again, the effects of the capital market trend have not yet trickled down to borrowers. The terms for property developments have gone up significantly. Even the interest rates for existing properties have increased, albeit not at the same brisk pace. One reason for this is that the funding premiums for banks remain high. We have also noted that some banks manage to achieve higher margins.

Summer Update on Housing Politics

As expected, the so-called rent freeze has become an established fixture on the federal politics agenda. There is reason to expect the rent control measure to be extended further. The opposite is true, however, for the rent cap. Few insiders still expect it to remain in effect for long. But the reasons for the scepticism vary. The overwhelming majority of experts consider the law unconstitutional both because the State of Berlin lacks the legislative competence to enact it and because of material flaws, i. e. its actual contents. Yet there are a few legal experts who merely find fault with the contents of the law while considering a rental law at state level to be in line with the German constitution, and this even though a recent ruling by the Constitutional Court of Bavaria rejected the notion. It is a difference that counts. If the Federal Constitutional Court were to confirm the legislative competence of the State of Berlin in this matter, only the contents of the rent cap legislation would have to be amended. It is to be hoped that the Federal Constitutional Court will not side with this minority opinion. We believe it

is the most likely outcome of the law suit.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof Steffen Sebastian

Prof Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG