Loading content …

30 April 2020

Plenty of Speculation, Most of it Baseless

Is the coronavirus pandemic the often-invoked “Black Swan” that will trigger a price slump on the real estate markets? We do not believe that an imaginary price bubble will pop or that an economic doomsday is looming. However, the crisis is still in a relatively early stage, and is novel in character. This makes forecasts difficult and subject to serious caveats. We have nonetheless ventured to provide an outlook for the various types of use.

At the moment, the real estate industry is positively bombarded with statements and comments on the ramifications of the coronavirus crisis. While some of the assessments are rooted in fact, others simply represent personal opinions.

It is virtually safe to say that the coronavirus crisis will precipitate a substantial recession and a massive increase in sovereign debt. And this will be true not just in Germany and Europe, but worldwide.

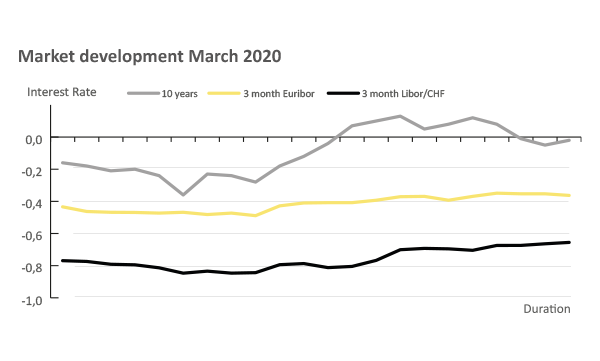

What we do know is that supervisory authorities and central banks fortunately still operate in a permanent crisis mode anyway, and constantly monitor the financial stability very closely. We are therefore very confident that everything is being done in the international arena to ensure, above all, that financial markets as well as banks and savings bank keep functioning even in the crisis. At the same time, this also implies that the currently low level of interest rates will not just be maintained, but that the ECB will radically step up its accommodative policy measures. It already initiated them by setting up a 750-billion-euro aid package on March. For the time being, however, the low interest rates have yet to filter down to the banks. The banks’ liquidity costs have skyrocketed in the wake of the crisis – because of the lack of mutual trust among banks.

In commercial real estate financing, we are clearly seeing a wait-and-see attitude among equity providers. Banks, by contrast, have not scaled back their business. Not only do they continue to stand by their loan commitments, even recently initiated credit processes are moving ahead. However, classic commercial banks in particular are currently overburdened with organisational chores. For one thing, they now have to expedite the process of digitising their mostly analogue processes. Safety precautions make it even harder to switch to home office solutions than it is anyway, necessitating a costly reorganisation of workplaces and in-house working hours for employees. In addition, a slew of funding applications for government aid through the KfW development bank needs to be processed. Since the new KfW loans, just like the former ones, stipulate a joint liability of the banks for 10 to 20 percent of the amount borrowed, each of these applications triggers a conventional loan approval process. The senior level is weighed down with tasks just as diverse. So, there is nothing bold about the prediction that the processing of new loan applications should be expected to take longer than usual. As far as we can see, new lendings not only take more time but have also become riskier and by no means easier to approve. We expect raised equity requirements to be among the first responses on the part of financiers. In fact, some banks will probably revise their lending policies completely.

In the opinion of some doomsday prophets, the coronavirus crisis finally marks the onset of the much-invoked “Black Swan” that will cause a supposedly existing real estate bubble to burst. As we see it, there is currently no basis for making such a prediction. While it is too early to say how the crisis will end, we do not believe that we are facing an economic meltdown.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof Steffen Sebastian

Prof Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG