Loading content …

20 January 2021

COVID-19 to Dominate This Year as Much as Last Year

Real estate financing in 2021 will continue to be defined by reticence, risk aversion, higher margins and lower LTVs. Especially in the segments retail and hospitality, the outlook remains bleak. The future of office real estate is fraught with grave uncertainty. Interest rates will remain on a low level for a long time to come.

2020 will enter history books as the year of the coronavirus pandemic. It was a difficult year for everyone, real estate lenders included. Our BF.Quartalsbarometer, which we introduced years ago in order to periodically gauge the sentiment among financiers, took a nosedive and hit an historic all-time low of -15.24 in April of 2020.

As far as actual business on the ground goes, we have noted that lenders have generally become more cautious and restrictive. For example, many institutes have further backed away from funding assets of the hospitality and retail types of use. At the other end of the scale, you find the winners of the crisis, the use types residential and logistics.

The figures of the BF.Quartalsbarometer reveal moreover that the corona situation has enabled banks to achieve higher margins on the market. According to our assessment, this is quite legitimate because the exposure has noticeably increased in some respects, which needs to be priced in on the bank side. Analogously, the loan-to-value ratio (LTV) dropped sharply, especially in the existing property segment. Here as elsewhere, a heightened sense of caution is in evidence.

Outlook

What does 2021 have in store for real estate financing? Will the year follow the trends outlined above? For starters, it is safe to assume that the pandemic will dominate the entire first half of 2021. Summer may come and go before the vaccine has been distributed nationwide and all the corona-related restrictions have been lifted.

We assume moreover that many repercussions of the crisis will only become evident in 2021 – particularly in the real economy. Its ramifications will spill over into the real estate market and leave their mark in the form of value adjustments. The only segment where we anticipate a largely stable development is residential real estate. According to an assessment by the Deutsche Bundesbank, insolvencies will remain manageable, at least for German banks.

On the international level, though, the Bank for International Settlements (BIS) has warned against overvaluations. Their assessment from early December suggests that banks, too, could—depending on the further development of the pandemic—experience distress in the wake of insolvencies and credit losses. Given the growing number of corporate insolvencies, the European Central Bank (ECB) has also urged banks to exercise more prudence. We therefore expect German banks to stick to their cautious approach and to steer clear of the use types retail and hospitality, which have been particularly hard hit by the crisis. Risk-tolerant alternative financiers could capitalise on the development.

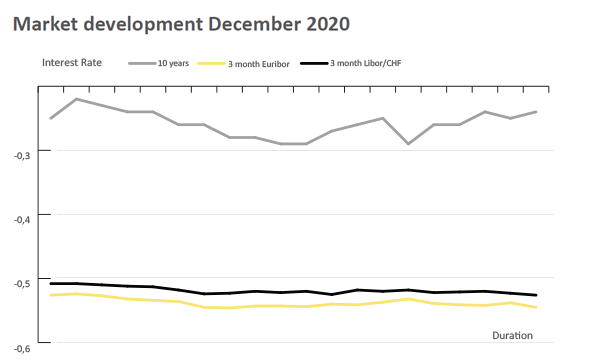

As far as margins and LTVs go, we do not expect the first half of 2021 to bring any major shifts. Nor is the trend in interest rates likely to change course significantly. On 10 December, the ECB announced its plan to earmark another 500 billion euros for bond purchases. In addition, the bond-buying scheme will be continued nine months longer than planned, meaning through March 2022. For the real estate market, this means: Due to the absence of investment alternatives, prices for asset classes that have been more or less spared by the pandemic would keep pushing up. Other segments, such as hotel and retail, will keep navigating troubled waters. There is a chance that the general business life could start making incremental steps back to normal during the third quarter of 2021. But it will take a few more months yet for the effects of the gradual recovery to trickle down to the real estate market and to real estate lenders. Conclusion: For many, 2021 will be yet another difficult year. But some real estate companies could actually benefit from the ongoing developments.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG