Loading content …

17 February 2021

ESG Concerns Everyone – Even Property Developers!

While providers of property funds and institutional investors have long been preparing for the looming ESG regulation, many property developers still consider themselves exempt. It is a dangerous misconception, because property funds and institutional investors are major buyers of new-build properties. It is high time for property developers to get ready. But here is the thing: The actual regulation has yet to be finalised and many questions remain to be answered.

The environmental, social and governance aspects of corporate conduct, or ESG for short, will probably be the dominant topic in the institutional real estate industry in 2021. Keywords in this context are “taxonomy” and “disclosure.” In the wake of implementing the Paris Climate Accord, the EU will create a unified classification system for sustainable activities (the “taxonomy”) and demand a high level of transparency on the market (“disclosure”).

Principally speaking, the Disclosure Regulation and the Taxonomy Regulation represent financial market guidance and therefore do not directly concern property developers. This explains why most property developers have not quite arrived in the new world of ESG, and have no idea what the EU taxonomy will require of them. Those who plan to keep putting properties on the market, though, will not be able to dodge the issue forever. It is of the utmost urgency therefore that property developer comprehend what institutional investors will soon be looking for.

So far, property developers have seen no need to go beyond the certification of their buildings and have rarely gone the extra mile to document the environmental effects as well. In future, this will no longer be enough. Any real property completed on 01 January 2021 or thereafter will indefinitely be considered new-build for regulatory purposes and will have to meet the corresponding requirements. Unless a property complies with the EU taxonomy, it will permanently be disqualified from the spectrum of investments that are eligible for institutional investors who seek to adhere to EU sustainability criteria.

That being said, the criteria for the real estate sector remain incomplete; indeed, the EU is falling short of its own road map, which appears to have been a bit ambitious. The actual classification is not to be defined until 2022 or 2023, that is, through the so-called implementation measures (Level II) of the Taxonomy Regulation. Only drafts have been tabled so far. For the time being, it thus remains quite impossible to compile qualified environmental or full ESG audits in the required form. Accordingly, the real estate industry will be forced, at least to some extent, to keep working with the latest national rules and regulations until further notice. The result will be an interim cacophony of different national standards, a scenario that the EU actually sought to avoid at all costs. In Germany, even the harshly criticised Energy Performance Certificate or EPC rating will stay in place for the time being. Nonetheless, institutional investors have started requesting a plethora of details from property sellers that, as often as not, depend on the reporting standards or benchmark systems a given company uses. And there are plenty of those, of course. This means that property developers will have to become every bit as transparent as property funds and insurance companies.

Sustainability covers not just environmental impact but also and especially governance or, differently put, the way a company conducts its business. Naturally, companies should have zero tolerance for unreported employment, pay minimum wages at the very least, and respect many other employee rights. The difference going forward is that they will have to provide evidence they did so. In practice, this will necessitate comprehensive documentation. Since these standards will have to be upheld by sub-contractors and supplier, too, the effort may tie up considerable in-house resources for a given property developer. Equally obvious is that compliance with the regulation will have to be prepared long before the start of construction in order to ensure conformity with EU standards.

ESG in the real estate sector goes well beyond “green buildings.” In the case of residential real estate, for instance, social sustainability requirements may call for the integration of day nurseries or similar facilities or else the installation of playgrounds beyond what national law stipulates anyway. Of course, tenant rights must be upheld in their entirety. Moreover, social housing development will keep gaining in significance as investment – and not just for church investors and other pro-bono investors.

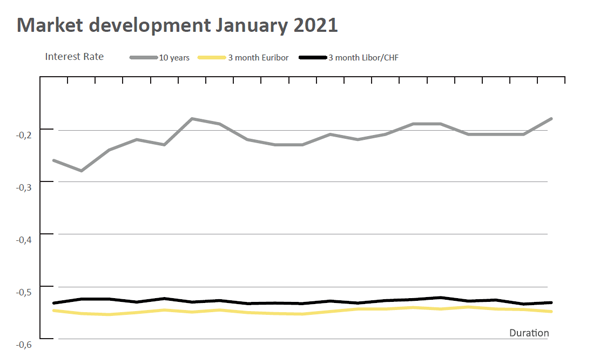

Interest Rate Development

January saw little change in long-term interest, matching the performance of the previous month. The 10-year interest rate swap rose but slightly, from -0.26 to -0.18 percent by the end of the month. The short-term interest rates more or less flatlined. The 3-month Euribor fluctuated between rates of ‑0.540 and ‑0.554 percent, ending the month with -0.548 percent, meaning just below the level at the start of the month. Analogously, the 6-month Euribor perked up minimally from ‑0.532 to -0.531 percent.

Outlook

At the moment, the EU is lagging behind its own ambitious schedule, and it remains anybody’s guess how compliance with the EU Taxonomy Regulation is supposed to be ensured. But property developers planning to sell to institutional investors should seek legal counsel early on in order to meet the prospective requirements on the investor side to the extent possible. Still, steering completely clear of risks will be quite impossible, given the hazy legal situation. This makes it all the more sensible to keep comparing notes with potential investors—and intensely so—before and during the construction phase. Doing so is particularly advisable in the case of forward deals.

The ESG regulatory effort will gather momentum in the years ahead. It is safe to say therefore that staying up to date on ESG requirements will, for a long time to come, remain a pesky duty for investors, asset managers and property developers, too.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG