Loading content …

31 January 2020

Isabel Schnabel, a moderate critic, joins the ECB Executive Board

The professor is generally in favour of the current monetary policy, but has also voiced concerns about its side effects. A change in monetary policy remains unlikely.

Isabel Schnabel – a professor of financial economics at the University of Bonn, and a member of the German Council of Economic Experts since June 2014 – was appointed to the Executive Board of the European Central Bank (ECB) with effect from 1 January 2020, as many had anticipated. In her new role, she will be responsible for market operations, placing her in charge of actually implementing the decisions made by the ECB’s Governing Council. What may at first sound like a purely administrative task is in fact one of the most influential positions within the ECB. The department headed by Schnabel is responsible both for the implementation of measures and for the evaluation of their effectiveness. As the result of a change in the distribution of responsibilities, her reach extends to statistics and the influential area of research. However, Schnabel will not be in charge of financial stability, her actual area of expertise and a field in which she is an internationally recognised and respected expert.

In 2018 Isabel Schnabel was a keynote speaker at the third Jahreskongress Finanzierung, an annual conference on financing organised by BF.direkt and RUECKERCONSULT in cooperation with IREBS. Her presentation – entitled “Droht ein Ende des Booms? Finanz- und Immobilienmärkte zwischen Konjunkturboom, Zinswende und Bankenregulierung” – took a look at the effects of rapid economic growth, interest rate policy and banking regulation on financing and property markets, as well as whether the boom was coming to an end. In light of the expanding economy at the time, Schnabel called for a “monetary policy turnaround”, among other things. She explained that a reversal of the contemporary approach would ultimately be unavoidable, despite being associated with tremendous uncertainty. Schnabel called particular attention to the risks for the real estate industry. By her judgement, even minor increases in the interest rate could result in a significant drop in prices.

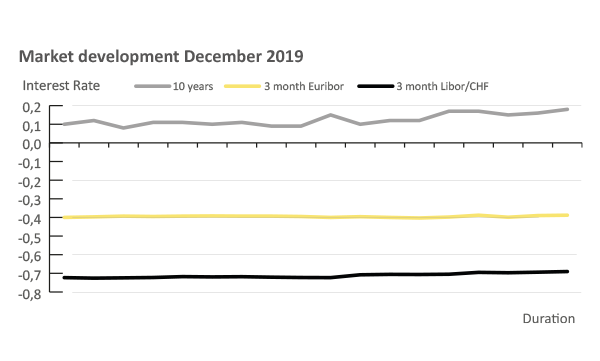

Interest rate trend

Long-term interest rates rose once again by a small margin month on month in December. The ten-year interest rate swap ended December at 0.16 per cent, having started the month at 0.10 per cent. The six-month Euribor also rose slightly from an initial level of -0.345 per cent to -0.325 at the end of the month. Over the course of December, the three-month Euribor varied only slightly between the -0.400 and -0.390 per cent marks.

Outlook

Despite Isabel Schnabel’s criticism of the central bank in the aforementioned presentation, many have called her a “dove” who tends to favour an expansive approach when it comes to monetary policy. Such sweeping generalisations are usually not terribly helpful, not only in Schnabel’s case. Schnabel has indeed frequently voiced doubts as to the effectiveness of individual measures. In various interviews and statements, however, she has rejected the sometimes excessive criticism, particularly from Germany. Yet as a member of the German Council of Economic Experts, she has also repeatedly drawn attention to the risks of low interest rate policy. So far, the 48-year-old academic’s statements have been critical yet undoubtedly nuanced. Given the state of economic development in the eurozone, we see no room for a monetary policy turnaround at the present time, regardless of Schnabel’s actual stance. Still, we believe that adjustments to the measures in place, such as the bond-buying programme, could be conceivable.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof Steffen Sebastian

Prof Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG