Loading content …

09 May 2022

Recession Looming in the Wake of Inflation?

As a result of global inflation and the Ukraine crisis, the general economic situation is deteriorating. A recession in Europe is becoming more and more likely. Interest-tightening may help to keep inflation in check, but it is useless for fighting a recession. Primarily affected at this time are property developers, and some projects have already been shelved. Our advice to property asset holders is to keep negotiating fixed interest rates.

At 7.3%, Germany’s inflation rate in April remained high year on year. At the same time, economic growth in Germany stagnated, increasing by only 0.2% quarter on quarter. Our national economy remains in a state of stagflation, meaning an inflation without economic growth.

Inflation drivers like supply bottlenecks are still just temporary phenomena, to be sure. But the coronavirus crisis, for one thing, is only taking a breather in Europe, whereas in China it is already causing havoc again. The war in Ukraine, on the other hand, has seriously exacerbated the shortages for many raw materials. As a result of the sanctions imposed in this context, which will probably remain in place for years, there is reason to expect high energy prices. And even without COVID-19 or the war in Ukraine, we are inevitable heading for a “greenflation,” i. e. elevated costs in all segments of the economy that are generated by the transition to carbon neutrality. The efforts of the entire western world to wean itself off Russian energy supplies as quickly as possible act as a catalyst in this context.

For the time being, the labour market appears to be untouched by these turbulences: Labour shortages in the building sector, for example, have persisted. However, this could change faster than expected. Construction projects everywhere in Germany are being shelved. New-build construction can be expected to take a nosedive by next year. Many other sectors of the economy present a similar picture. Amazon, the world’s biggest retailer, reported that it suddenly finds itself overstaffed. Just a short while ago—during the pandemic—the exact opposite had been the case. While many companies restocked their inventories and warehouses during the coronavirus pandemic, high prices have now caused demand to dry up.

At the bottom line, redundancies and a recession have in any case become much more likely now.

In times of crisis, market players tend to turn their back on risky asset classes like equities to embrace risk-free investments like government bonds or US dollar as the global currency instead. We have already noted tell-tale signs of the phenomenon. The S&P 500, a stock index tracking the 500 largest listed US companies, lost almost 10% last month. During the same period of time, the US dollar rallied. The euro is down to 1.05 US dollars, compared to 1.11 US dollars as recently as early April. The fact is driving up prices in the short term – and the inflation rate with it, because many imported goods and raw materials have to be paid in US dollars. But in the longer term, export-oriented countries like Germany stand to benefit from a devaluation of the euro. A weak euro will boost German exports and with it the country’s economy.

In order to combat inflation, the ECB plans to incrementally raise interest rates during the second half of the year. The US Federal Reserve Bank, or Fed, has already done so. Meanwhile, the countries of Europe are reporting nominal growth of their economies at best and are gravitating ever closer toward a recession. What makes this problematic for the ECB is that interest hikes are not a good way to deflect a recession. On the contrary, a recession has in itself deflationary effects that resemble those of tightening interest rates, and that would make the latter obsolete to some extent. Then again, keeping interest rates low is not helpful against supply bottlenecks and war-related shortages in raw materials either. Accordingly, extremely low levels of interest are virtually impossible to justify in times of high inflation.

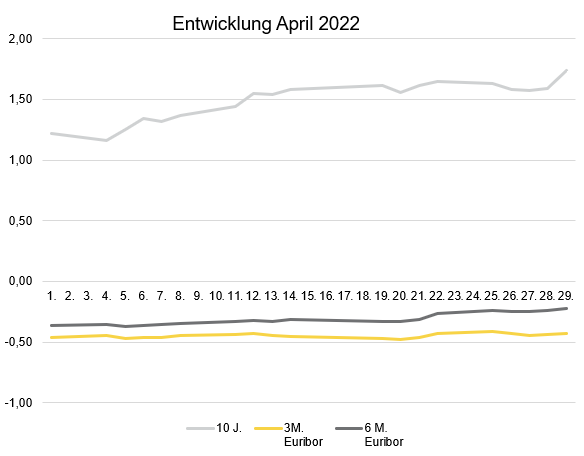

Interest Rate Development

Long-term interest rates went up noticeably in April. The 10-year interest rate swap increased from 1.22 at the beginning of the month to a month-end value of 1.74 percent. The increase for short-term interest rates was just as fast. The 3-month Euribor rose from -0.461 at the beginning of April to -0.429 percent at month-end. The 6-month Euribor also surged, from -0.362 percent at the beginning of the month to -0.226 percent by its end.

Outlook

While there is no need to panic at this time, property asset holders should act quickly. Safe to say is that interest increases have been announced, and that long-term interest rates will keep going up. Surveys suggest that experts brace themselves for 3 percent interest on ten-year interest rate fixings before the end of this year. In the short term, the ECB can be expected to tighten its lending rates the way it already announced. But it would be premature to speculate how the ECB’s interest rate policy will evolve in the medium term in response to the economic situation in Europe. From our point of view, it is no longer a realistic proposition for the ECB to back-paddle because of the looming recession or for interest rate markets to return to accommodative easing.

That being said, the pressure on real estate prices will increase as well. This in turn will also raise the risk margins for banks.

One thing is for sure: The low-interest cycle has bottomed out, and is gone for good. However, this is still a good time to establish long-term fixed interest rates. Despite the unexpected dynamic of recent week, we believe that this observation will remain relevant even for long-term financing arrangements negotiated a few months hence.