Loading content …

31 January 2023

How Much Higher Could Interest Rates Climb?

The brisk recent rise in interest rates is having an impact: According to the Association of German Mortgage Credit Banks (vdp), prices for residential real estate declined by 0.7 percent over prior quarter in Q3. This first price drop in twelve years could be a harbinger of worse to come. But it is far from certain whether interest rates will keep going up in future and thereby put further pressure on real estate prices. After all, there are several reasons why interest rates cannot keep climbing indefinitely. A first glimmer of hope inspired by the latest inflation data also suggests a possible pause in the rate-hiking cycle.

As the Federal Statistical Office announced, Germany’s consumer inflation rate stood at 10.0 percent, down from 10.4 percent in October in the first month-end dip of the year. Analogously, the producer price data most recently published were also better than expected: To be sure, producer prices rose by 34.5 percent in October year over year. But surprisingly, they dropped by 4.2 percent month over month. However, investors expecting the central banks to abandon their interest-tightening cycle quickly will probably see their high hopes dashed. Inflation remains on a high level, and central banks have signalled their intention to make further interest rate moves. This is illustrated by the fact that the core inflation in the United States unexpectedly rose from 6.3 percent to 6.6 percent in October, with financial markets now expecting a key lending rate level of almost 4.75 percent by March 2023.

Nevertheless, there is growing evidence that the high inflation rates will level out over the coming months, and that central banks will allow themselves the flexibility to slow the interest-tightening cycle. For one thing, the costs of energy, commodities and freight have softened noticeably, and even in Europe, gas prices plummeted in recent weeks. Secondly, supply bottlenecks and delivery issues whose origins date back to pandemic times are gradually dissolving. The most important reason for the easing of the inflationary pressure is the incipient economic downturn. It is indicated by the currently inverted yield curve. Short-term interest rates are rising in anticipation of upcoming key interest rate increases, whereas long-term interest rates are stable because of the expected economic slowdowns and downstream interest rate cuts anticipated as a result. This will coincide with a slowing wage and price pressure in the economy. In addition, inflation rates will ease year over year due to upcoming base effects.

Here is another reason why interest rate moves are likely to slow down: In addition to keeping price levels stable, it is part of the monetary watchdogs’ brief to preserve the stability of a national economy’s financial system. Since the level of interest rates plays a key role for the stability of prices and financial systems, it is reasonable to expect a conflict of objectives going forward. The United Kingdom has impressively demonstrated how a rapid and unchecked rise in bond yields can threaten the stability of the financial system, and necessitate interventions by the central bank.

One thing is for sure: Interest rates cannot keep rising indefinitely without threatening the stability of the financial system. It is true that the major financial institutions are clearly better prepared than they were at the start of the financial crisis of 2008. However, the indebtedness of the private sector and the public sector has steadily increased during years of accommodative monetary policies and during the pandemic with its unprecedented fiscal stimulus programs. Moreover, real estate prices have soared in recent years, with the interest rate reversal exposing them to the risk of valuation adjustments, which could pose an additional threat to financial stability.

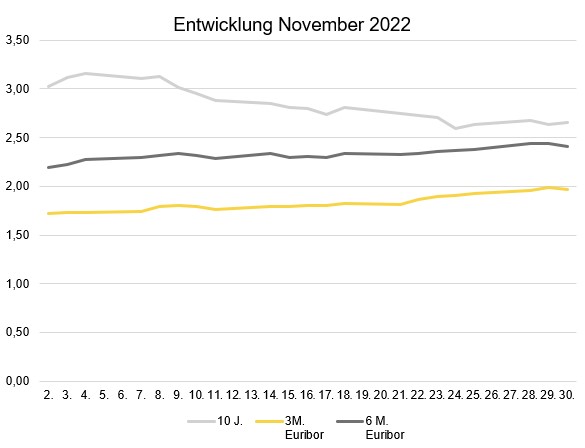

Interest Rate Development

Over the past month, short-term interest rates went up once again, whereas long-term interest rates declined. For example, the 10-year interest rate swap dropped from 3.03 percent at the start of November to 2.64 percent last time we checked. The 3-month Euribor, which equalled 1.726 percent at the beginning of the month, ascended to 1.984 percent by 29 November. The 6-month Euribor presented a similar picture: It reached a temporary peak as well, rising from 2.19 percent to 2.442 percent.

Outlook

Considering the current inflation forecasts and the still significant interest rate differential with the US, further interest rate increases in the Eurozone are probable. Yet the question presents itself just how far the ECB can go with its interest rate hike without triggering a real estate and debt crisis. The central bank will therefore reach a point where the risks will discourage a further tightening of the monetary policy.

How soon this point will be reached remains to be seen, though. Especially property asset holders with current loans should not assume therefore that their interest rates will go back down. Rather, it is more likely that the softening interest rates of recent weeks represent a temporary decline of the sort we have often seen in the past.

Compared to the long-term mean, building finance rates in Germany still seem moderate. Historically speaking, building finance rates have been known to exceed 6 percent. Accordingly, borrowers are well advised to keep seeking to refinance their holdings prematurely rather than wait for the interest-tightening cycle to peak. This is particularly true when you consider that banks, while still willing to finance, review each case very carefully now. Processing times, especially for complex financing arrangements, take several times as long as they used to. At the beginning of this year, inventory financing arrangements still took six to eight weeks to conclude. Today, the standard period is three months, and six months or more are no longer uncommon. So, if you have a fixed-interest period of less than two years, you should start looking for a follow-up financing offer right away.