Loading content …

07 April 2021

BF.Market Radar April 2021

Neither Inflation nor Higher Interest Rates to be Expected

Rising interest rates, inflation expectations and their ramifications for the real estate industry remain the most talked-about topic. We discussed the issue repeatedly with experts both from academia and from the field last month, occasionally even in the form of public debates. The gist being that we see no sign of a turning point at this time.

Long-term interest rates have gone up by around 0.3 percentage points since the start of the year; the ten-year interest rate swap rate crossed back into the positive range for the first time in months. The trend is complemented by a modest increase in inflation. Many market players and some observers fear it will trigger an automatic mechanism: With inflation inching up and prompting interest rate hikes, their concern is that the higher interest level will cause property prices to start softening next. But that would be a bit precipitous to say.

For one thing, we are not aware of any serious rise in interest rates. We have admittedly not seen an increase by 0.3 percentage points in months, yet it is not a particularly high level compared to the past months and years, neither in absolute nor in relative terms. Roughly a year ago, interest rates were on a comparable level. If we go back as far as mid-2019, we will find even higher interest rates. Yet real estate prices have kept going up steadily in the time since. Naturally, it is not to be expected that the price growth of the past ten years will continue at the same pace. But the latest interest rate hike does not suffice as evidence to project a drop in property prices. It would be quite a different matter if long-term interest rates had gone up by 3.0 percentage points over an extended period of time. Interest firming up by 0.3 percentage points for about one month, however, should not be considered relevant news for the real estate markets.

Much more important is the question how interest rates will behave in the medium term. Many economists believe that raising the lending rate has ceased to be an option altogether for the ECB and that accelerating inflation will be the inevitable result. Their key argument being this: A large number of member states of the European currency area, most notably Italy, simply cannot afford higher interest levels. Moreover, an already extreme indebtedness has been driven up further by the pandemic, and substantially so. According to this view, even high rates of inflation would hardly cause interest to tighten. But again, things are not quite that simple. The ECB is unlikely, of course, to opt for a sudden shift in monetary policy which would probably trigger the next crisis in public finances. What makes it so improbable is not that the ECB would be compelled by its so-called “fiscal dominance” to jeopardise price stability in the interest of state finance, a practice actually prohibited. Fact is rather that the need to keep prices stable and the wish to stabilise public finances are not incompatible.

Accordingly, there is reason to believe that the ECB would take no action for a while after the inflation stabilises at the targeted level of 2 %, thereby giving governments some time to exploit the softened real interest rate for debt clearance. Such a period would make real estate particularly attractive and another round of price hikes conceivable. If inflation remained stable, the ECB would slowly raise its lending rate by downscaling its accommodative monetary policy measures. The ECB would be unlikely to engage in any such measures without announcing them well ahead of time. So, there are no surprise moves to be feared. This should give governments ample time to consolidate their households without triggering unwanted repercussions for the business cycle. We need to bear in mind here that sovereign debt is largely borrowed on fixed long-term interest rates. Changes in the level of interest rates would thus have a limited effect on national budgets only. That much for theory. Meanwhile, economists and other analysts are debating hands-on issues like the question how much time the ECB will give governments to clear their debts through inflation. The time frame could have serious implications for the price trends on real estate markets.

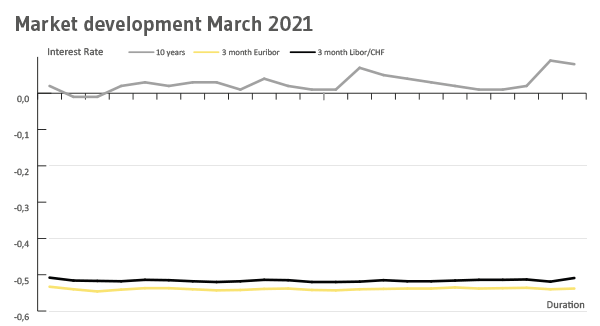

Interest Rate Development

Interest rates kept inching up slowly in March. Specifically, the 10-year interest rate swap rose from -0.02 at the start of the month to 0.08 percent by the end of March. Short-term interest rates remained largely stable. The 3-month Euribor declined slightly, from -0.533 percent at the start of the month to -0.538 percent by month-end. Similarly, the 6-month Euribor virtually flatlined with interest rates between ‑0.508 and -0.520 percent.

Outlook

From our point of view, the higher interest scenario outlined above remains very remote at this time. The ECB has in no way heralded an end to the low-interest cycle. Instead, the ECB has implemented additional accommodative policy measures in the context of the COVID-19 pandemic, even and especially for long-term interest rates. Many restrictions—such as the 30-percent cap on the government bonds of a given country or the credit requirements—were lifted in order to preserve at least a shred of a chance that the monetary targets of the ECB can still be achieved. The slightly accelerated inflation this year will not force the ECB off its accommodative course. In fact, no response of any sort is to be expected unless the inflation rate remains well above 2 percent for an extended period of time. And even then, the inflation trend would have to be self-supporting, i. e. fuelled by sustained high consumer demand rather than by monetary policy alone. Midway through a pandemic, however, the chance that we might see this happen is, sadly, as remote as rarely before.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG