Loading content …

12 May 2021

BF.Market Radar May 2021

Market Prices Moving Away from Mortgage Lending Value

Banks have to base their lendings on the rather conservative mortgage lending values. This is proving to be a true challenge, as market prices keep on climbing. Find out why it is high time to reform the German Mortgage Lending Value Ordinance and what other issues lenders are currently grappling with.

Having enthralled the banking sector for several weeks, the spectre of inflation has ceased to be an issue for most insiders. It is quite evident that, while there will be a short-term inflation increase in the wake of the pandemic, we will probably see no permanent interest rate hikes and certainly no reversal of the monetary policy. This means that, as long as the European Central Bank (ECB) makes no drastic policy changes, the main stabilising anchor of the real estate market will remain in place.

It is against this background that banks have long abandoned the reticence they showed during the early stage of the crisis, even though they have not yet returned to the status quo ante. The end of the pandemic is admittedly still a long way off. But the sheer fact that its end is in sight has eliminated the sense of complete uncertainty about the way forward, and reduced it to a more or less normal threat. This is something the banks and appraisers know how to handle. That said, the equity requirements of banks and other financial institutes are definitely above the pre-crisis level still. Valuers, too, continue to show a degree of wariness, especially in regard to commercial real estate. It remains to be seen in what ways and to what extent the retail, hotel and gastronomy sectors will be able to resume their business.

During crises like the current one, banks and appraisers have a particularly hard time managing the widening gap between mortgage lending values with their long-term horizon and current fair market values. In many places, the unsecured share of financing arrangements has long crossed the 50-percent mark. As a reminder: The minimum interest rate that has to be applied to determine the mortgage lending value of apartments is still 5 percent. And this rate applies without any differentiation anywhere in Germany. Although it is quite inconceivable midway through this crisis (and during the run-up to the general election) to start scrutinising these parameters, the need to reform the mortgage lending valuation is a subject the industry ought to tackle next year.

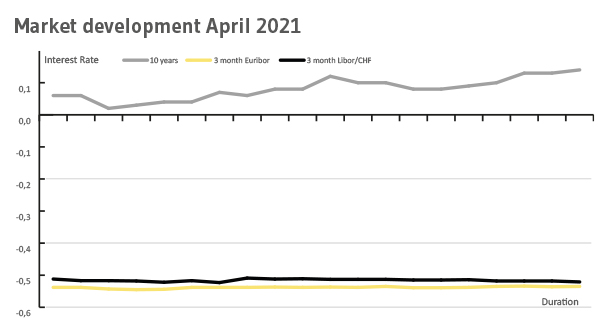

Interest Rate Development

Long-term interest rates saw another moderate increase in April. The 10-year interest rate swap was raised from 0.06 at the beginning of the month to a month-end value of 0.14 percent. Short-term interest rates remained largely stable. The 3-month Euribor made slight gains, from -0.538 percent at the start of the month to ‑0.535 percent by the end of the month. By contrast, the 6-month Euribor dropped minimally from ‑0.512 to ‑0.521 percent.

Outlook

Over the next few months, the interest situation will require little attention from us while the coronavirus crisis will (hopefully) absorb less and less of it. Instead, the industry will have to engage in an intense effort to cope with the existing ESG regulations. At the same time, all housing market players should brace themselves for a further tightening of the rent control measures under the incoming government, which is likely to be a coalition including the Greens. Even now, this should be taken into account in current calculations and assessments.

Disclaimer:

On 21 April, Prof. Dr. Steffen Sebastian, IREBS, hosted a roundtable at the 5th Annual Congress on Financing featuring Brigitte Adam FRICS, managing partner of ENA EXPERTS, Francesco Fedele, CEO of BF.direkt AG, Thomas Jebsen, member of the board of Deutsche Kreditbank AG, and Sascha Klaus, member of the board of Berlin Hyp AG. Some of the takeaways from this panel are reflected in this edition of Marktradar. However, the contents of Marktradar represent exclusively their authors’ opinion. The information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG