Loading content …

28 September 2021

A Coalition Government of Social Democrats, Greens and Liberals the Most Likely Scenario

The outcome of Germany’s imminent general election remains an open question. Although it has ceased to be realistic that the candidate of the Greens will carry the day, all other scenarios are nearly as novel. It is safe to say, however, that we are in for a big change.

Since climate change and affordable housing are two of the crucial issues on the political agenda this time, the real estate industry will have to look hard at the possible outcomes at the ballot box. There is a good chance that the first-ever coalition government of three parties will be formed on the federal level.

The forecasts of recent weeks suggest that the Social Democrats will have more options than the other parties. From our point of view, this makes a coalition of Social Democrats, Greens and Liberals the most likely outcome despite all the uncertainties. Unsurprisingly, a look at the election manifestos of Social Democrats, Greens and Liberals reveals stark differences between the ideas of Liberals on one side and Greens on the other side as far as the real estate industry is concerned, especially the regulation of the housing market.

Social Democrats and Greens plan to tighten the “rent freeze” rent control scheme and to make it permanent, whereas the Liberals would like to rescind it. Moreover, Social Democrats and Greens wish to see residential rents capped, the Social Democrats seeking to peg it to the inflation rate, while the Green want to limit rent reviews even after energy refurbishments. This clashes with the Liberals’ proposal to aid the socially distressed with housing benefits or alternatively with social housing. Interesting to note is that Liberals and Greens intend to curb share deals and both parties also favour the idea of facilitating homeownership for first-time home buyers by lowering the real estate transfer tax for them.

The Greens are the party whose manifesto discusses the subjects of housing, building and town planning in greatest detail. They plan to prevent lease terminations over late rent payments, to increase and stabilise the social housing budget, and to create a million additional social flats within ten years. A hazily phrased section advocates the option to create “state-law regulations” for strained housing markets – which has a distinct “rent cap” ring to it.

Regrettably, the propositions put forward by the Liberals are less than innovative. They would like to see the allowance for housing construction raised to 3%, to eliminate some of the construction regulations, to lower construction costs, to expedite approval procedures and to encourage infill densification.

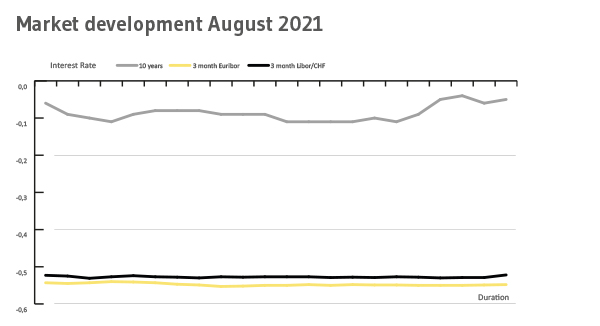

Interest Rate Development

Long-term interest rates initially softened in August before rebounding toward the end of the month. The 10-year interest rate swap, for instance, was -0.06 percent at the start of the month, and dropped all the way to -0.11 percent in the course of the month, only to bounce back up to -0.04 percent by month-end. Short-term interest rates remained more or less stable. The 3-month Euribor softened slightly, from -0.543 percent at the start of the month to -0.550 percent by its end. The 6-month Euribor dropped from -0.523 to -0.529 percent.

Outlook

From our perspective, a coalition of Social Democrats, Greens and Left Party is unlikely even if it had the necessary votes. It is to be hoped therefore that we will be spared a replica of Berlin’s city government on the federal level. Allowing for the uncertainty of forecasts, we consider a government headed by the Social Democrats the most probably scenario – which would leave the matter unresolved, at least for apartment seekers.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG