Loading content …

04 November 2025

Realism and Practicality Defining the Market

Real estate financing markets, while presenting a stable picture, remain challenging in November. Demand concentrates on the logistics and residential segments whereas the refinancing wave continues to dominate the market action. The ECB is holding its course – a signal of stability that has a calming effect on the financing market but offers no relief. Persisting risks include, above all, the potential inflation pressures and a resurgence of long-term interest rates.

Following the turbulent summer months, Germany’s real estate financing markets have lately entered a phase of practical realism – and this sentiment was clearly in evidence as early as the Expo Real trade fair. Although the general situation remains strained, market players have gradually adapted to the new normal: higher, if predictable, interest levels, strict capital adequacy requirements and selective lending strategies.

At the same time, the refinancing wave continues to be the main issue within the industry. A large number of borrowers whose loans, taken out during the low-interest cycle, will soon expire are looking for follow-up financing solutions. Worth noting in this context: While high price expectations persist, experienced structurers are finding ways to implement refinancing arrangements, even complex ones, on viable terms. The funding volume is gradually growing – albeit with a clear focus on residential and logistics. Office and retail real estate, especially in secondary locations, is still hard to finance.

In an interesting move demonstrating the adaptability of the industry, Aareal Bank recently securitised some of its low-risk debt portfolio in order to free up capital for riskier commitments. The transaction shows how banks with innovative structures actively manage their balance sheets and thereby create risk buffers.

Interest Rate Development

By contrast, there are no news on the interest front: As expected, the ECB stayed its course in October and left its key lending rates unchanged. It was a plausible decision and the proper thing to do. Even though the inflation within the eurozone is steadily descending toward the two-percent target mark, the price pressure in the service sector remains high. Nor have the inflation hazards prompted by geopolitical threats and the protectionist policy of the US Government gone away.

For the real estate industry, this means: The current level of interest rates continues to be a challenge – albeit a predictable one. A premature interest rate cut would have raised false expectations and undermined the credibility of the ECB. Accordingly, ensuring stability is of the essence.

While the Fed is already lowering its key lending rates in the United States—amidst debates whether its decision is influenced by politics rather than financial conditions—the ECB stays committed to continuity. Such a disciplined monetary policy will strengthen the long-term stability of the financial system and thus ensure stability in real estate financing, too.

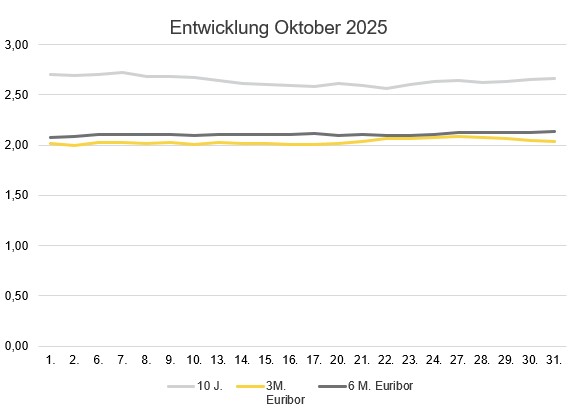

Money market and capital market rates largely followed a sideways trend in October. The 3-month Euribor increased slightly from 2.02 to 2.05 percent while the 6-month Euribor rose from 2.10 to 2.13 percent. The 10-year swap rate moved within a range of 2.63 percent to 2.70 percent.

This means it continued the sideways trend it had been following since late summer. Markets have priced in neither major interest rate cuts nor interest rate hikes for the coming months.

Outlook

As the year is nearing its end, the situation presents a picture of muted optimism. Market players have learned to live with the new environment. Transactions have begun to move ahead whenever realistic pricing coincides with capital servicing capacity. At the same time, there is growing evidence that operators have started actively exploiting the opportunities that are created by stable interest rates and by the intensifying competition among lenders.

That being said, the risks associable with the interest rate development persist. While there is every reason to believe that the ECB will maintain its current interest rate stabilisation policy, the situation itself remains unstable. Inflation risks are still relevant, fuelled particularly by high pay settlements and the persistent price pressure in the services sector. If these factors were to gather momentum, the capital markets could quickly start pricing in higher long-term interest rates again. Geopolitical jitters, prompted by the escalated trade conflict between the United States and China, for instance, could also trigger new price pressure and hamper the fight against inflation. Finally, we need to remember that the ECB and other central banks keep reducing their holdings of bonds and other assets – a process whose structural effect is an increase in capital market rates.

This explains why many banks remain cautious. They insist on sound debt service profiles and conservative loan-to-value ratios. Alternative financiers are somewhat more flexible but charge higher interest in return. Financing markets are in good working order, but defined by cautious and selective behaviour. And so the bright outlook is increasingly replaced by realism and practicality.