Loading content …

21 June 2021

Gradually Firming Inflation, Exploding Costs of Building Material

Inflations rates keep going up, as many experts predicted they would. In a parallel development, the prices of certain building materials are skyrocketing. In combination, the two factors have exacerbated the unease felt in the construction business, and made the short-term planning and calculation of projects more difficult. However, the shortage in building material will be alleviated in the medium term.

Inflation rates have regained a level not seen in quite some time. In April 2021, it amounted to 2.0 percent year on year, and May is expected to have seen a similar rate. Its ascent, however, was predictable because the pandemic produced various one-off effects. For instance, prices of energy products in particular had taken a nosedive at the start of the crisis. Moreover, the standard rate of the German sales tax went from 16 percent back up to 19 percent, and the CO2 tax was introduced, pushing up the prices of passenger car fuels and the costs of heating and electricity. Without the energy prices, the inflation rate would have equalled 1.2 percent only. Further price hikes are to be expected as pandemic-related restrictions are successively lifted, and the pent-up consumption demand of recent months is met. With this in mind, the—so far moderate—inflation trend is unsurprising and matches our expectations, as reported in the past two editions of the Market Radar. Interest rates have therefore shown a muted response. For consumers and property asset holders, loans are still available at interest rates below 1.0 percent.

That said, there are segments currently experiencing very brisk price growth, one of them being the building sector. In addition to substantial cost increases, it is facing supply bottlenecks for many products such as sawn timber, insulation materials or steel. Timber products, assuming they are in stock at all, have seen price increases of up to 400 percent, while the price of reinforcing steel has gone up by about 30 percent. The root cause of these issues is mainly the pandemic-related disruption of international supply chains which have yet to be fully restored. But companies have also been busy stocking up on these materials to be prepared for future bottlenecks. The press has rather aptly compared the situation in the construction business with the run on toilet paper seen last year. While this trend emerged toward the end of last year, it did not gather significant momentum until the past few months.

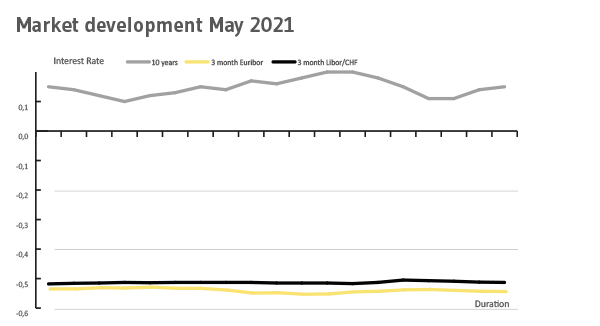

Interest Rate Development

Apart from minor fluctuations, the long-term interest rates remained stable. The 10-year interest rate swap, for example, equalled 1.15 percent both at the beginning and the end of the month. Nor has short-term interest experienced any major changes. The 3-month Euribor declined moderately, from -0.535 percent at the start of the month to ‑0.544 percent by month-end. By contrast, the 6-month Euribor rose slightly from ‑0.518 to ‑0.513 percent.

Outlook

It is still too early to say whether the price increase and supply bottlenecks are signs of a long-term trend. But even if the situation was to persist in the medium term, meaning beyond the end of this year, there is plenty of reason to assume that the cause is a pandemic-related disturbance. What makes us think so is the absence of serious structural changes. On the one hand, demand for building material—which was strained to begin with because of the economic stimulus measures in the United States—has simply continued to increase. This kind of effect could easily linger for several years. On the other hand, ESG and other climate policy measures will increase the importance of timber frame construction as a substitute for conventional reinforced concrete, and thus further increase the demand for wood products. The problem here is that wood production can be scaled up only to a certain degree. It takes a tree that is suitable for sawn timber production up to 120 years to grow.

On the whole, though, we assume that we are not looking at an inflationary development but that the availability of building material will improve as the year progresses. It is actually reasonable that prices will soften slightly, even though they won’t return to the pre-crisis level. Property developers and contractors will once again have to get used to permanently higher commodity prices.

Projects already under construction that failed to factor in possible cost overruns may run into trouble now. In many cases, the contracts of tradesmen will also have to be renegotiated. The first legal disputes in this context have already been brought before the courts. The bottom line being that the unease in the building industry is here to stay.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG