Loading content …

09 January 2026

Outlook for the Real Estate Market in 2026: Unexpected Impulse from Abroad

Our first look at 2026 inspires a touch of optimism. The major tendencies informing the German real estate market are likely to continue unchecked. Surprisingly, what few impulses we see at this time tend to come from abroad. Despite glum domestic sentiment, we have noted a growing demand for assets and financing options in Germany among foreign investors. The country appears to present itself more to advantage from the outside looking in than it does from within. It remains to be seen whether the outside stimulation will facilitate a noticeable market recovery.

Market Environment

We are entering 2026 with cautious optimism. The crisis, while far from overcome, has lost its edge. The various market segments clearly continue to evolve out of sync. Office real estate—especially in peripheral areas—and retail real estate in virtually any segment keep having a hard time, whereas other use classes show a much more robust performance.

In spite—or perhaps because—of tightening regulations, housing remains scant. Short supply coincides with keen demand, and this should keep the segment stable throughout 2026. Logistics assets are also sought after, so much so that interesting property development opportunities can open up in this asset class. In the latter case, alternative financiers play an increasingly important role. While banks keep enforcing very high capital adequacy requirements, alternative lenders are far more flexible in their assessments of value creation through the procurement of development rights and property developments.

Striking to note is also the increasing demand for German real estate from abroad, especially from the United Kingdom and Italy. Interested parties are seeking to either buy or finance German properties. From the perspective of foreign investors, Germany is as attractive as ever – possibly due to a lack of convincing alternatives. Despite the expansion of its “separate asset pool”—which should rather be called separate debt pool—Germany’s sovereign debt remains moderate compared to other countries. France, for instance, has a much higher sovereign debt and has been deemed incapable of reform for years, which has steadily exacerbated the country’s fiscal situation.

Even the United States has lost appeal. The political risk has soared, and the steadily growing sovereign debt is increasingly perceived as structurally problematic. Against this background, many international investors continue to see Germany as a comparatively stable anchor within an uncertain global environment.

In addition, the structural distribution of German cities implies a locational advantage. While the real estate investment markets of many countries are dominated by one or two metropolises, Germany’s “Big 7” cities offer a much wider selection to choose from. This variety of choices permits a better regional diversification and makes the market particularly attractive, not least on the portfolio level.

At the same time, the macroeconomic environment remains precarious. The situation in industrial manufacturing, especially in the automotive industry, is particularly worrisome. So far, the German Government has failed to demonstrate convincingly that it has a coherent concept to overcome the industrial crisis. The priorities set by the political factions—with the Social Democrats seeking to raise pensions and the Christian Democrats trying to roll back welfare benefits—seem almost grotesque, given the scope of the structural challenges. They are certainly not a good way to resolve the key issues of competitiveness and productivity.

Interest Rate Development

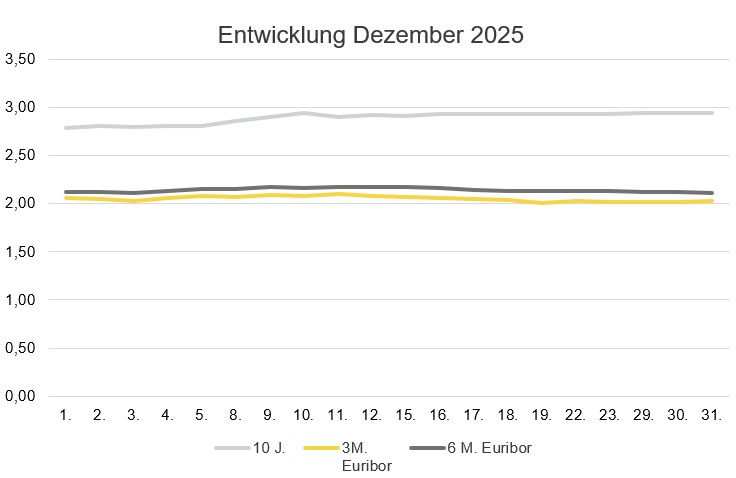

By the end of 2025, money-market and capital market rates remained stable on an elevated level. The 3-month Euribor hovered around 2.03 percent in December, and the 6-month Euribor around 2.11 percent. On the long-term side, the 10-year swap rate perked up slightly in the course of the month, ending the year at just below 2.95 percent.

Thus, the trend of recent months continues: Interest levels, while fluctuating, do so within a narrow range. Markets anticipate neither interest rate cuts any time soon nor another interest tightening cycle. The inflation rate is close to the target mark, but the price pressure in the services sector has not eased. Accordingly, the ECB will probably maintain its reticent course through the early months of 2026.

What this means for the real estate industry is that its environment will stay predictable, if demanding. There is no reason to hope for interest rates to come down. Financing continues to be available, but it presupposes sustainable cash flows, conservative loan-to-value ratios and realistic price expectations.

Outlook for 2026

Our expectation for 2026 is not that the market will quickly transition to a boom phase but that it will gradually sort itself out. The gaps between the different use classes and locations will continue to widen. Residential and logistics real estate will remain stable, whereas many office and retails assets keep facing structural challenges. What inspires optimism more than anything else is the growing interest among foreign players. With this in mind, the Market Radar will be published in English and Italian, too, going forward.

Opportunities are opening up particularly for investors with liquid capital, long-term horizons and access to flexible funding structures. Alternative financiers will play a major role in this context. Generally speaking, 2026 will be defined by differentiation rather than by dynamic market action – a year offering selective opportunities in a persistently demanding market environment.