Loading content …

17 August 2021

Permanently Higher Building Material Prices Expected

The ongoing inflation trend is following a predictable pattern and should be no cause for alarm. Much more serious are the persistent supply bottlenecks for building materials and the concomitant price hikes.

In the Market Radar 06/2021, we had already indicated that the inflation rate would be likely to rise in the second quarter. The observation required no prophet gift. After all, it was common knowledge that the expiration of the sales tax holiday would coincide with the introduction of the carbon tax. We also need to remember that prices a year ago were so low because the onset of the COVID-19 pandemic prompted an economic dip. While not at all surprising, it is annoying to see that the usual suspects of the sensationalist press are dramatizing this into a piece of bad news. More reputable media differed in their coverage, the weekly DIE ZEIT being a case in point as it headlined the inflation subject with: “Fear Ye Not.” Then again, we find it quite astounding that many representatives of the real estate industry are getting nervous over the inflation trend.

Not so astounding, by contrast, is that the European Central Bank (ECB) sees no reason to revise its monetary policy over these construction-related temporary price increases. Various media actually reported that the ECB changed its definition of inflation just for the purpose. But that is inaccurate. The definition, which was already revised in more specific terms in 2016, states unambiguously that an inflation must be self-sustaining and sustained (see Market Radar 01/2016). The subdued response by the capital markets reflects the fact. Interest rates have barely budged over the accelerated inflation; in fact, long-term swap rates have gone down. Terms and conditions both for commercial and for private loans are effectively unchanged.

But the pricing of building materials and raw materials points to a much graver development for the real estate industry. Not least because there is less reason to assume that the development is of temporary nature. It may be true that the short-term price fluctuations for sawn timber and round timber illustrate that prices in certain segments are clearly exaggerated. But prices have evidently gone up for building materials across the board. Graver yet are current delivery problems, which make the planning of construction periods an even greater challenge than it already is. That said, price increases and construction time overruns are an issue quite familiar to property developers and general contractors as well as to the financing banks. Renegotiations between all project stakeholders are currently the rule. One of the most challenging feats these days is the conclusion of new general contractor agreements. Here, it is becoming more and more common for developers and general contractors to split the risk. In short: The situation is challenging, but not disastrous.

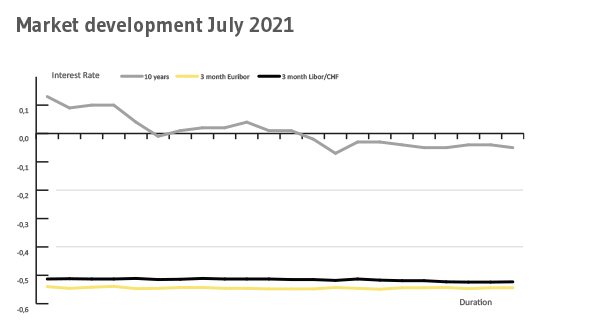

Interest Rate Development

For the first time in a while, long-term interest rates dropped rather noticeably in July. The 10-year interest rate swap, for instance, fell from 0.13 percent at the start of the month to -0.05 percent by the end of the month. Short-term interest rates remained more or less stable. The 3-month Euribor softened slightly, from -0.540 percent at the start of the month to -0.544 percent by its end. The 6-month Euribor registered a modest drop from -0.513 to -0.523 percent.

Outlook

Despite the difficult situation in the building materials market, waiting and hoping for lower prices is generally not an option. It may well be that construction prices will decline again once the disruption of the international production chains caused by the COVID-19 pandemic are overcome. But the role that increased demand from abroad plays is virtually unpredictable. In the case of the United States, the economic stimulus package will, of course, expire at some point. But the data coverage of the international building materials trade is patchy, and there is currently no way to gauge the effects that possible shifts in demand could have on building prices with any degree of certainty. It is by no means unlikely that material prices will remain permanently inflated. Going forward, developers and contractors will have to share the risks, along with the opportunities, arising from fluctuating prices.

Disclaimer:

The article reflect the opinion of the authors. Nevertheless, the provider and authors assume no liability for the accuracy, completeness and timeliness of the information provided. In particular, the information is of a general nature and does not constitute legally binding advice.

Publisher

Francesco Fedele Prof. Dr. Steffen Sebastian

Prof. Dr. Steffen Sebastian

Holder of the Chair of Real Estate Finance

at IREBS, University Regensburg

Francesco Fedele

CEO, BF.direkt AG